The Homeowners insurance policy consists of two sections. In the previous issue we discussed Section I of the Homeowners’ policy. Section I covers homeowners’ properties. Section II covers Liabilities. Section II is similar in all homeowners’ policies that we discussed in the previous issue.

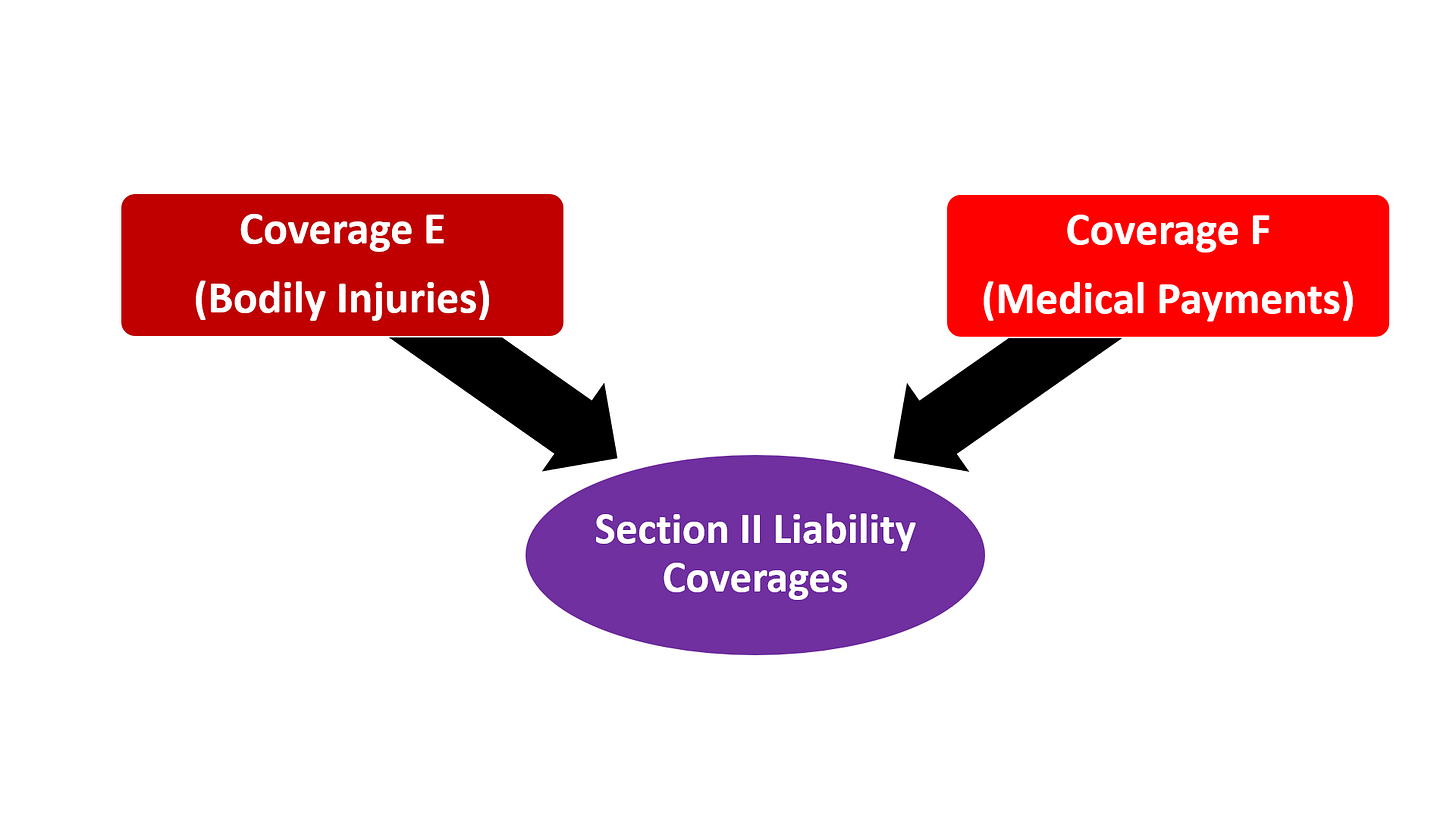

Section II typically consists of two sections, Coverage E and Coverage F. These coverages supplement Coverages A, B, C and D from Section I. Coverage E protects the insured from bodily injury or property damage to others. These coverages apply to personal activities that may occur on premises or locations listed in the Declarations section of the policy. As far as premises or locations are concerned, here are some considerations.

Residences newly acquired during the policy period are usually covered as are temporary locations where you are residing. If you have an accident-prone family member, this type of coverage is especially useful. Insurance companies will provide a defense even if the insured is not at fault.

If you are renting a location for an event or party or non-business gathering, you want to ensure you are covered for any liabilities arising out of such events. Whether it is a slip and fall or any other kind of liability, the peace of mind such coverages provide is priceless.

The base liability provided for one incident or occurrence is usually $100,000 but this limit can be increased for an additional premium.

Coverage F covers medical payments to others for up to three years, from the date of the incident or accident, that caused bodily injury. This coverage applies to bodily injuries if the injured person was on the premises with your permission. This applies to bodily injuries that may be caused accidently by you. This also applies to bodily injuries that may be caused by your pet. In certain instances, however, the limits of your homeowners’ liabilities may not be sufficient to cover all damages. In such instances, an Umbrella Insurance policy may be more appropriate.

An Umbrella policy covers damages over and above the limits of your homeowners’ policies. Usually, an Umbrella policy will have a Self-Insured Retention Limit provision. This Self-Insured Retention Limit works like a deductible. When liabilities are covered by an underlying homeowners’ policy, the Umbrella policy covers excess damages. However, when the underlying policy does not cover damages, the insured must cover the Self-Retention Limit in full before the insurance company covers damages under the Umbrella policy.

Section II of the homeowners’ policy also provides additional coverages, provided they are endorsed separately, in the policy. We have discussed the permitted incidental occupancies endorsement in the previous issue for property. The permitted incidental occupancies endorsement also applies to the Liability section for medical payments arising out of injuries that may have been caused while conducting business activities on the premises.

We have also discussed the business pursuits endorsement in previous issues. The Business Pursuits endorsement covers any full-time, part-time or occasional activity of any kind, undertaken for financial gain, and includes an occupation or profession. Other endorsements include the Personal Injury Endorsement and the Home Day Care Endorsement.

A Personal Injury Endorsement covers the homeowner against libel and slander. A Personal Injury Endorsement may offer coverage in a variety of other situations, such as false arrest, illegal search and seizure and invasion of privacy. The Home Day Care Endorsement provides liability coverage for those in your care. Most insurance companies will determine eligibility based on the number of children. If you have more than six children in your care, you will likely need a commercial insurance policy.