In previous issues, we have discussed how to begin a career in insurance. One way to begin a career in Insurance is to prepare for and pass the state licensing examination for a particular line of authority such as Life, Health, Property or Casualty. We have also discussed other certifications such as the Certified Insurance Service Representative (CISR) credential, the Certified Risk Manager (CRM) credential, and the Certified School Risk Manager (CSRM) credential. In this issue, we will examine the work actuaries do. Actuaries apply mathematical tools, statistical tools and finance concepts to analyze the costs of risks and uncertainty. One concept that actuaries are keenly familiar with is the Law of Large Numbers. The Law of Large Numbers says that as the sample increases, the average of the sample approaches the average of the population. Most actuaries work for insurance companies and employment of actuaries is projected to increase by 21% over the next ten years.

To be successful as an actuary, you will need a variety of skills. First, you will need strong communication skills. Actuaries often need to explain complex technical concepts in simple terms to those without a strong background in mathematics and statistics. Actuaries also need strong technical skills that encompass analytical skills, quantitative skills and system skills. Most insurance companies have proprietary internal systems to manage customer data. Actuaries must build their forecasting models with the help of programmers to integrate the costs of risks in premium calculations for individual customers.

In the case of life insurance, this involves building models with a person’s health characteristics. In the case of auto insurance, this involves building models with a person’s driving history. In the case of homeowners’ insurance, this involves building models with the characteristics of the home. In the case of commercial insurance, this involves building models, with the unique risks that the business is exposed to. It is important to note that insurance is a solution to pure risks not speculative risks. Pure risks are managed by purchasing insurance policies whereas speculative risks are managed by purchasing financial derivatives. If a manufacturing company wants to mitigate risks to its building facilities, it will need an insurance policy. If the manufacturing company wants to limit its commodity risks, it will need a financial derivative. Actuaries also need strong personal effectiveness skills such as auditory abilities, perceptual abilities and interpersonal skills.

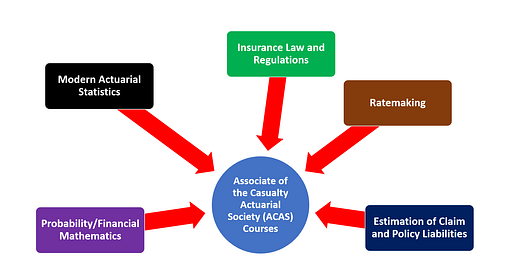

You can begin your career as an actuary by earning the Associate of the Casualty Actuarial Society (ACAS) credential. There are several courses that candidates need to pass to earn the credential. Initial courses include Probability and Financial Mathematics. The Probability course is intended to provide candidates an introduction to assessing risk quantitatively. The Financial Mathematics course is designed to introduce candidates to Time Value of Money concepts such as Present Value and Future Value. Next candidates will need to complete Accounting, Finance and Economics courses. Candidates can complete the Accounting, Finance and Economics courses in a variety of settings. This will be followed by a course in Modern Actuarial Statistics. The Modern Actuarial Statistics is designed to provide candidates an experience of actual practice. Further candidates will need to take courses in Financial Economics, Risk Management and Insurance Operations, Insurance Accounting, Insurance Law and Regulations, Ratemaking Techniques, Claim Liabilities Estimation and Policy Liabilities Estimation. The Ratemaking courses introduces the candidates to the general methods of ratemaking and the underlying requirements such as data collection, calculation methods, assumptions and implementation. The Policy Liabilities course covers the standards of practice for unpaid claim estimation. This course also covers how actuarial concepts are adapted to account for liabilities arising in complex risk transfer agreements. Complex risk transfer agreements include excess insurance and reinsurance contracts.

A career as an actuary is certain intellectually, personally and financially rewarding. The key is a strong aptitude for mathematics and statistics.